Brazil Real Estate Investment Guide

Buy property in Brazil 100% remotely — with full support at every stage.

At ALTUM ESTATE, we guide you through the entire process:

from obtaining a CPF and selecting a property,

to signing contracts, registering ownership, and managing your investment.

Whether you’re investing for rental income or long-term growth, our team ensures a smooth and secure experience — fully remote, fully supported.

1. Choose Your Investment Strategy

The first step toward a successful investment is selecting the right strategy. Consider the following:

-

Investment Timeline:

A horizon of 3–5 years offers the best balance of risk and return. -

Project Stage:

Options include pre-sale, foundation stage, or ready-to-move-in. The earlier you invest, the higher the risk — and the higher the potential return. Ready-to-move-in units typically offer stable returns of 5–7% annually with minimal risk. -

Exit Plan:

Plan your resale in advance to maximize profits and avoid losses from rushed decisions.

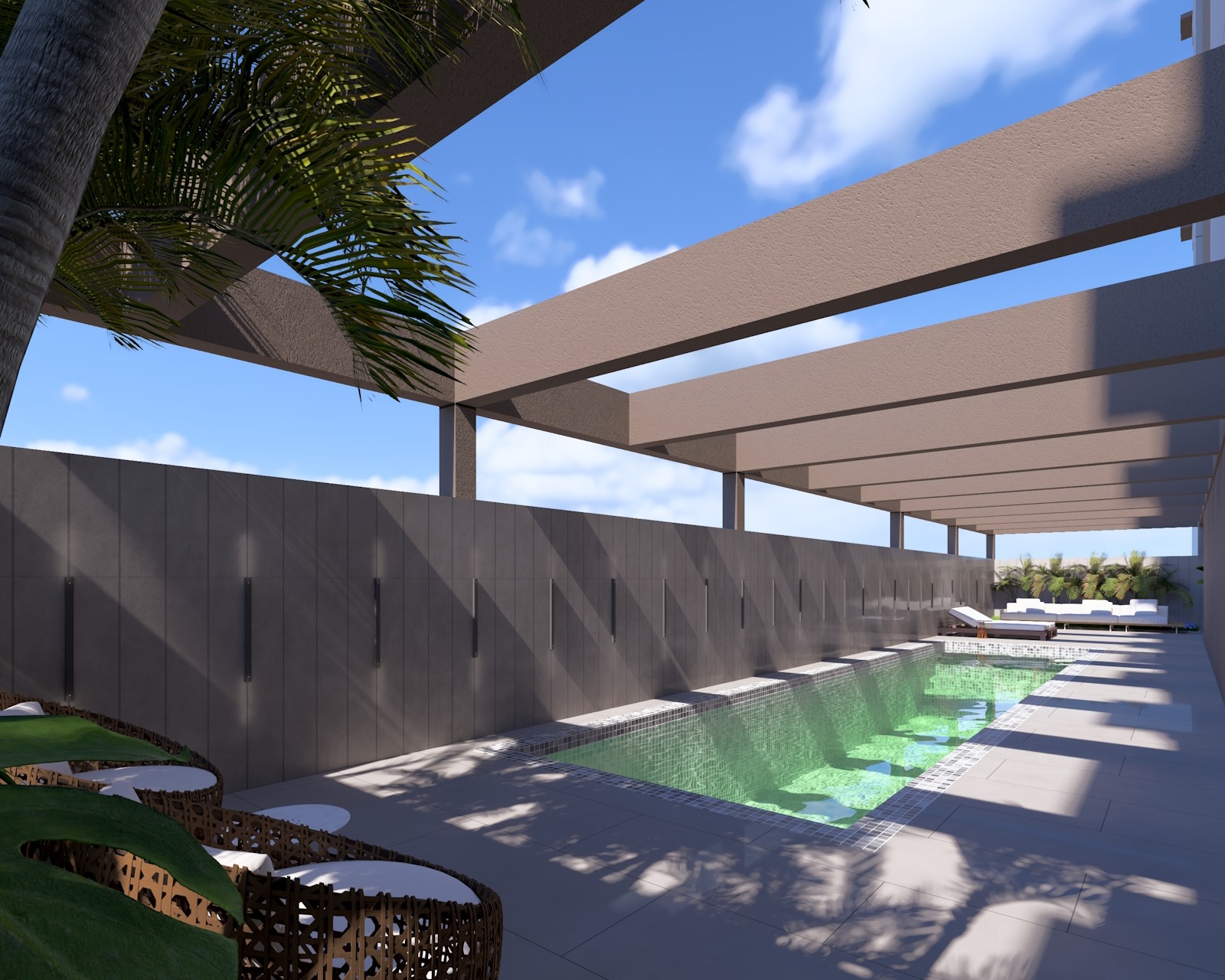

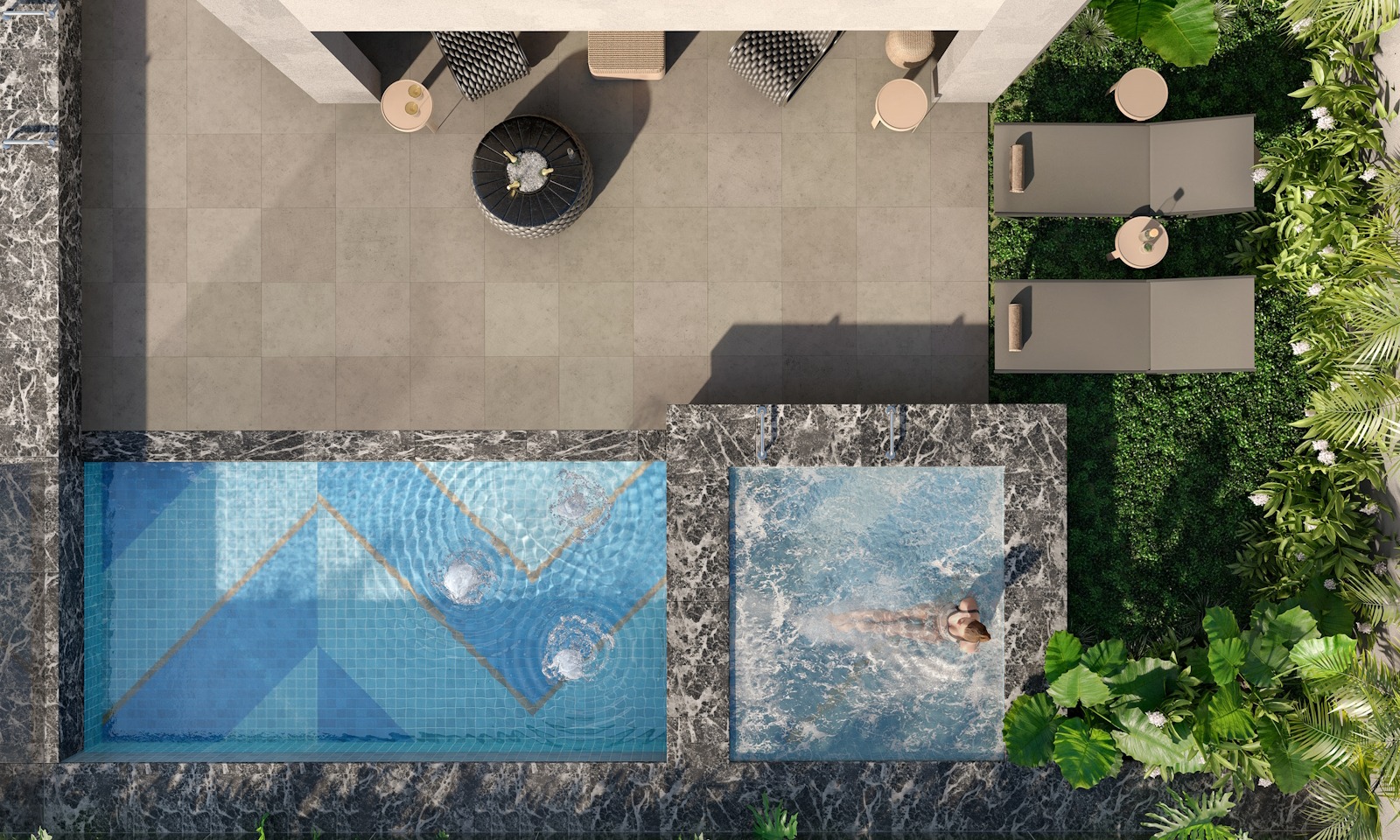

2. Select the Right Property

Choosing the right property is critical:

-

Reliable Developer:

Brazil has a strong base of local developers with 50–70 years of proven experience. Many have delivered dozens of successful projects. -

Project Selection:

Consider price, location, and expected delivery date. -

Unit Selection:

Different views, floors, and layouts may vary significantly in price — even with the same square footage. Price differences of up to 25% are common within the same project.

3. Obtain a CPF (Cadastro de Pessoa Física)

To buy property in Brazil, you need a CPF — similar to a taxpayer ID:

-

Register Online:

Visit the Brazilian Consulate’s website. -

Submit Documents:

You’ll need your passport and birth certificate. -

Attend Your Appointment:

Receive your CPF number. We recommend creating a digital CPF to sign documents remotely.

Tip:

Even if you’re only visiting Brazil short-term, a CPF is useful — it’s required for everything from ordering an Uber to buying a SIM card.

4. Sign the Sales Contract

The purchase process includes several steps:

-

Preliminary Agreement:

Negotiate payment terms. The initial down payment is usually 15–20%, with the remaining amount paid in installments or upon completion. -

Final Contract:

Use your digital CPF to sign remotely. Carefully review all attachments, including floorplans and rental terms. -

Payment:

Make the initial payment and stay on top of the schedule for the remaining installments.

5. Register the Property

The final step is formal ownership registration:

-

Payment Confirmation:

Ensure all installments have been completed. -

Ownership Registration:

The property can be registered remotely at the Cartório (official registry office). You’ll need to pay the ITBI tax (typically 2–4% of the property value). -

Property Management Agreement:

A local property manager can handle rentals and maintenance for a fee (usually 20–30% of rental income). -

Remote Oversight:

All steps can be managed online, allowing you to earn passive income from abroad.

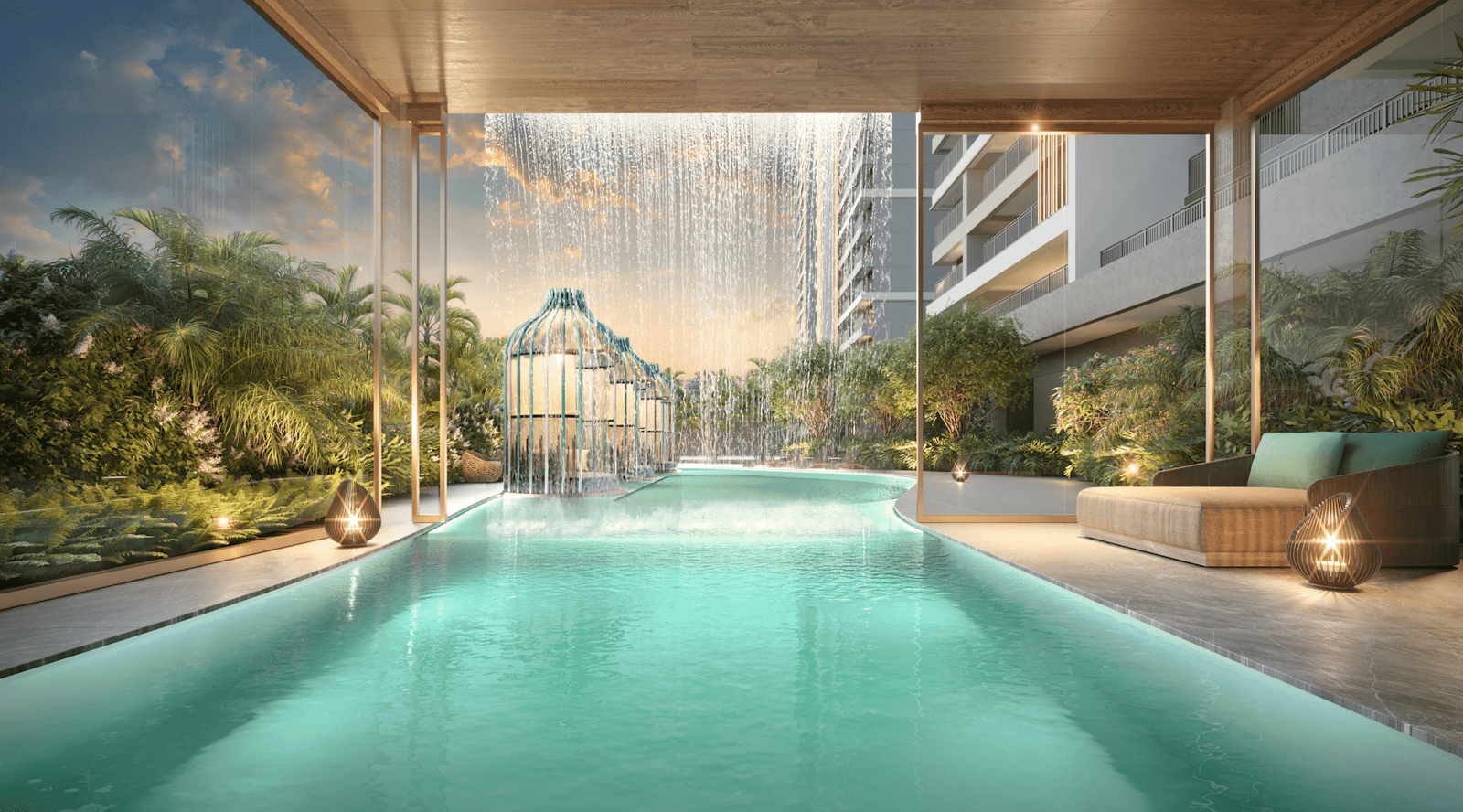

Why Consider Investing in Brazil?

If you’re looking at real estate in Dubai or Bali, Brazil deserves your attention too — and here’s why:

-

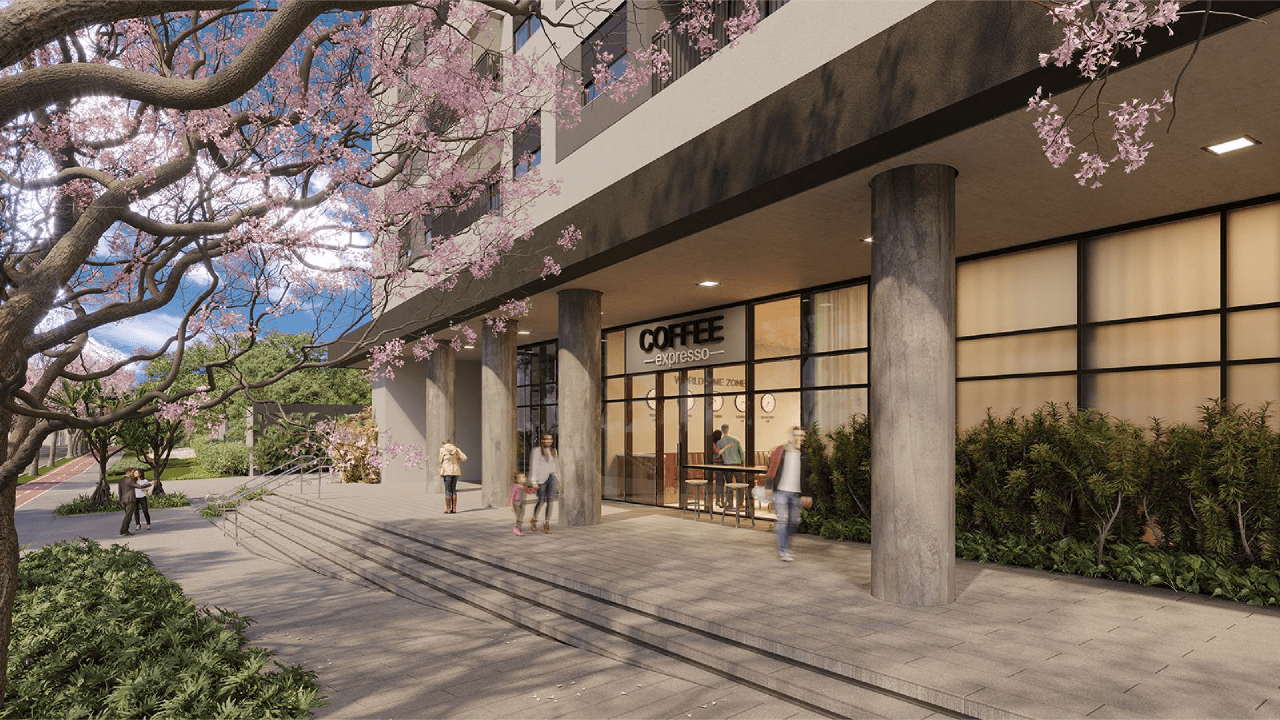

Affordable Prices:

Property in Brazil is often significantly more affordable than in Dubai or Bali. -

High Returns:

Real estate in Brazil can generate returns of up to 10% annually. -

Reliable Developers:

Most Brazilian developers are local, well-established, and trusted — many with 50+ years in the industry. -

Growing Market:

Brazil is one of the fastest-growing real estate markets in Latin America.

Conclusion

Investing in real estate is easier than it seems — especially with the right guidance.

You don’t need to fly abroad or negotiate in person. ALTUM ESTATE handles the entire process for you, providing full support and peace of mind every step of the way.