📍 Location Still Leads — Focus on Central & Southern Zones

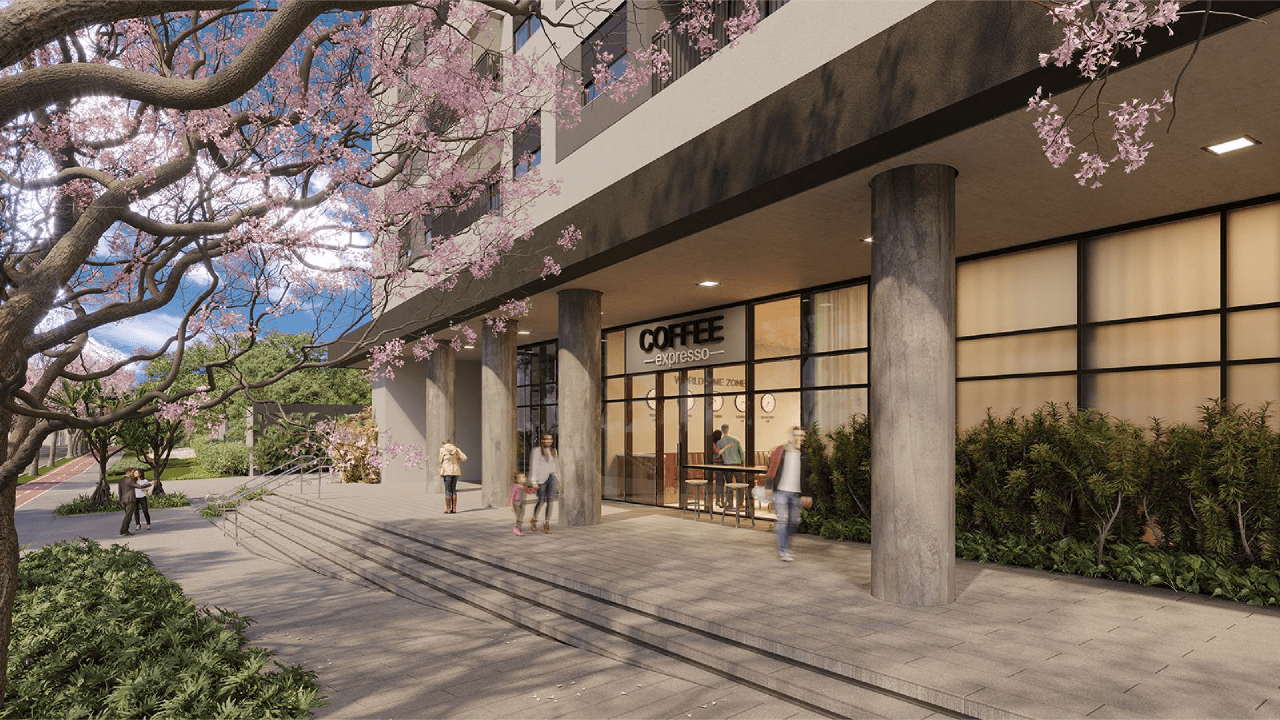

Searches and buying interest are highly concentrated in central and southern São Paulo — especially in neighborhoods like Itaim Bibi, Vila Mariana, Brooklin, and Saúde.

-

These areas offer good infrastructure, metro access, lifestyle amenities, and proximity to key corporate hubs.

-

They also show above-average price growth and consistent rental demand.

Investor tip: Centrality, convenience, and public transport remain the top drivers of property value and tenant demand.

📈 Apartment Prices Are Rising Above Inflation

According to DataZAP and FipeZAP indexes:

-

The average price per square meter in São Paulo has risen by 11.5% year-over-year, outpacing Brazil’s official inflation (4.83%).

-

Some districts exceeded 15% growth, particularly where new infrastructure or gentrification is underway.

If you’re looking for capital appreciation, early-stage investment in transforming neighborhoods (e.g., Brooklin, Vila Marianna) may offer the best risk-reward ratio.

🏙️ Smaller Units Dominate Buyer & Tenant Preference

Data shows the most in-demand units are:

-

Apartments up to 70m², typically with 1 or 2 bedrooms;

-

Units with one parking space and one suite in the case of buyers;

-

No-parking apartments for renters, as these are more affordable.

There is a clear trend toward compact living, driven by affordability, location convenience, and new urban lifestyle preferences.

📊 Demand for Rental Property Is Booming

Rental listings in São Paulo saw a steady increase in demand throughout 2024:

-

The average lead-to-listing ratio improved by 9.2%.

-

Rentals of 1-bedroom apartments grew the fastest in demand, rising 15.2% in value year-over-year.

-

Studio units and 2-bedroom apartments also maintained strong search volumes.

Whether you’re looking for rental yield or short-term appreciation, the fundamentals remain strong.

👩💼 Who’s Renting and Buying? The 2025 Profile

The typical consumer profile, according to DataZAP:

-

Woman, married, aged 35–50 (Gen X), with a university degree;

-

Prefers to stay in their current neighborhood;

-

Main priorities: Metro/train access (buying), and proximity to work (renting).

Understanding your potential tenant or buyer helps you select the right unit type and location.

✅ Key Takeaways for Apartment Investors in São Paulo

-

Go where the demand is — Southern and central districts are the most active.

-

Smaller units = broader appeal — Studios and 1–2 bedroom units are easiest to rent and resell.

-

Rental yields are solid — With rising values and demand, São Paulo remains landlord-friendly.

-

Public transport is a key filter — Properties near metro lines perform best.

-

Buy early in growing districts — Areas like Brooklin, Saúde, and Vila Prudente are rising stars.

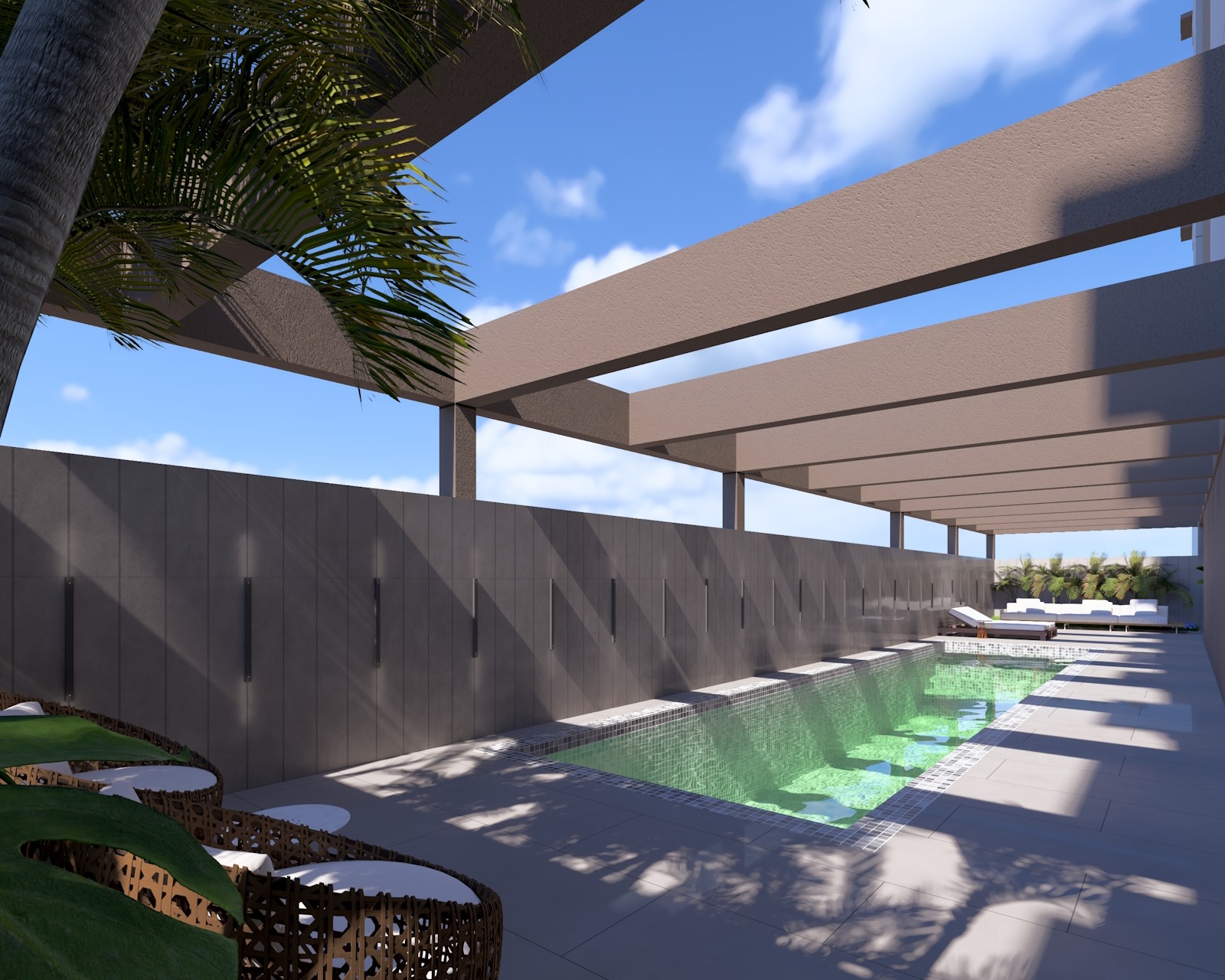

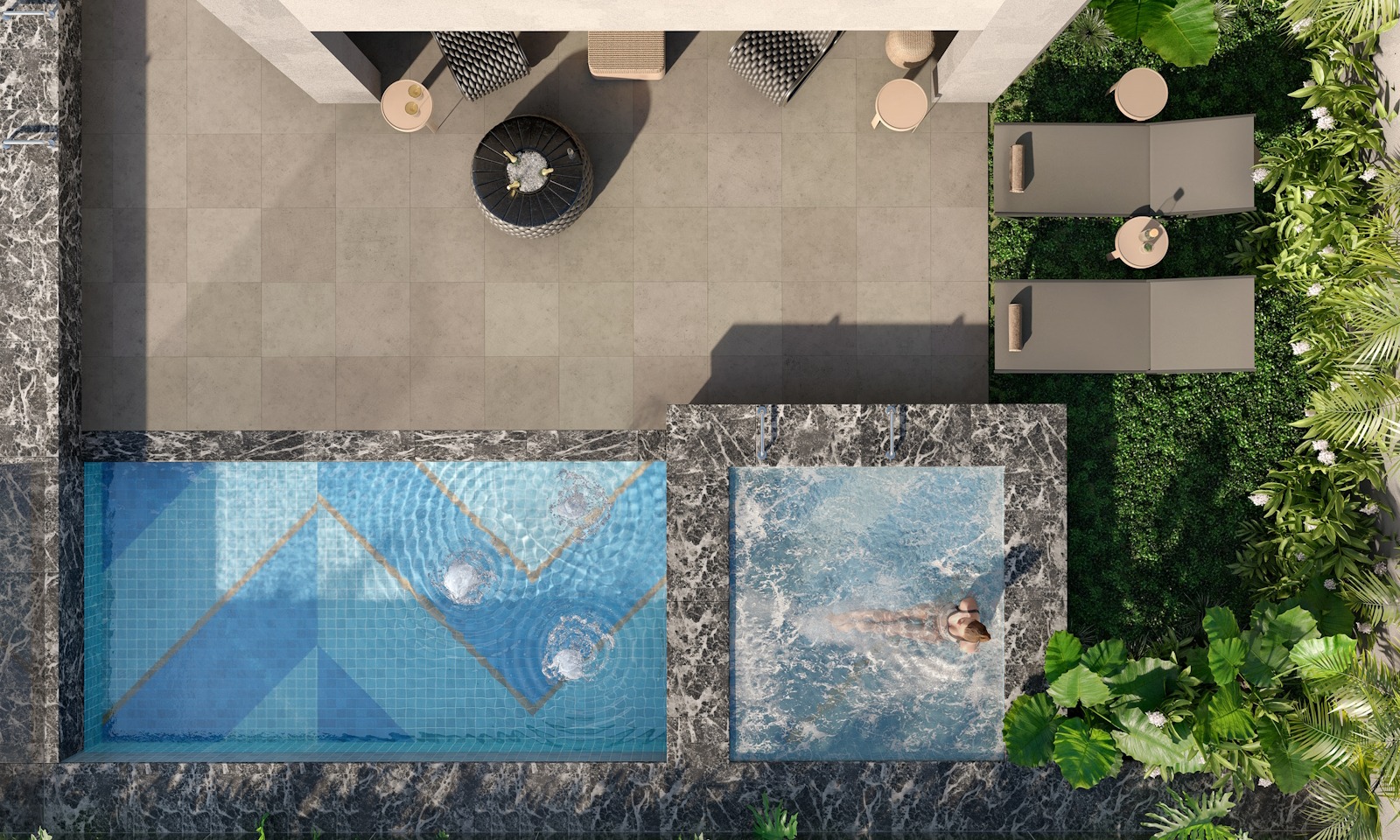

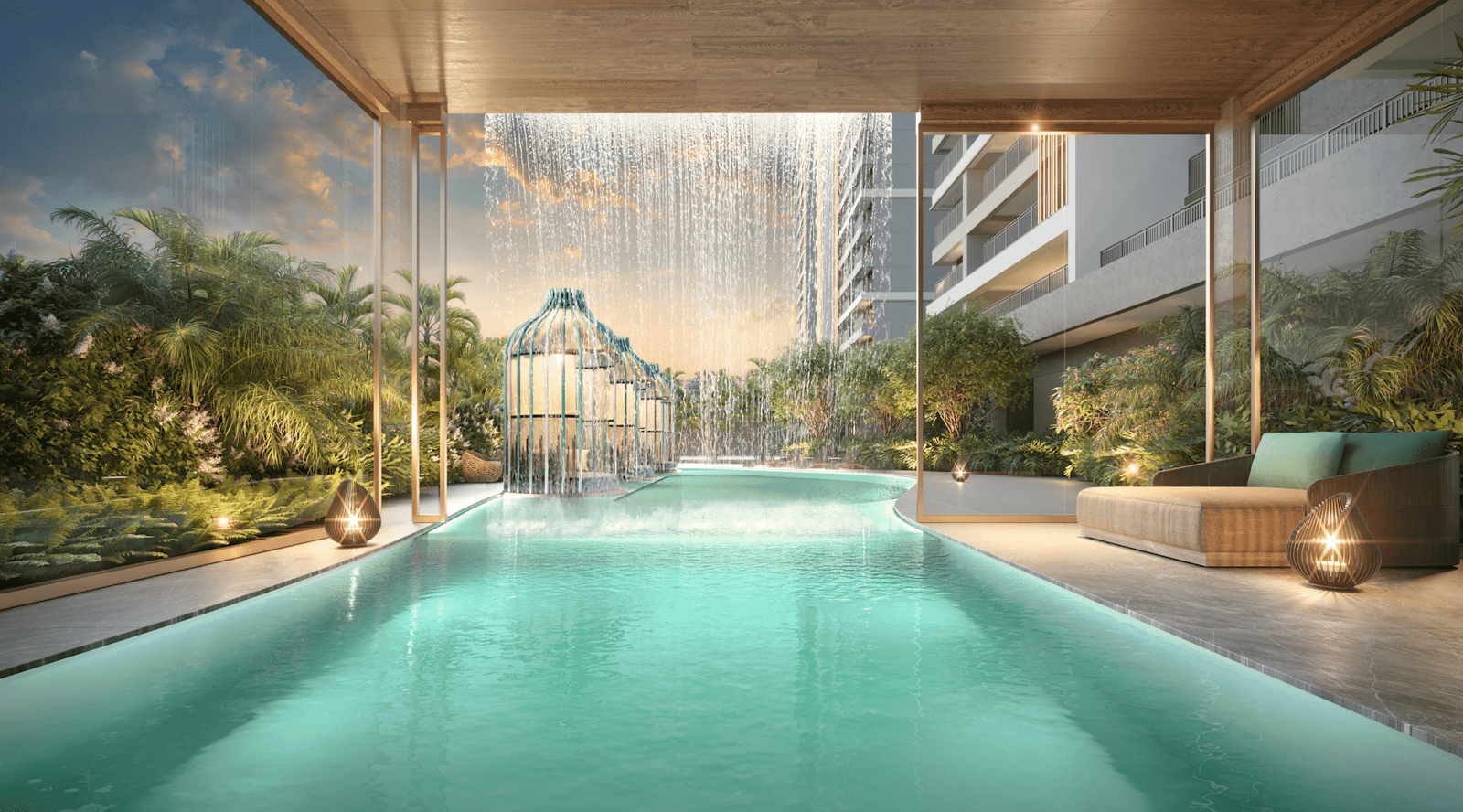

💼 Altum Estate: Helping You Invest in the Right Property

At Altum Estate, we specialize in guiding international investors through Brazil’s real estate market. We provide:

-

Access to pre-vetted developments;

-

Market-based analysis and projections;

-

Legal and transaction support;

-

Full after-sales and property management services.

Whether you’re new to Brazil or looking to expand your portfolio, we help turn market data into smart decisions.